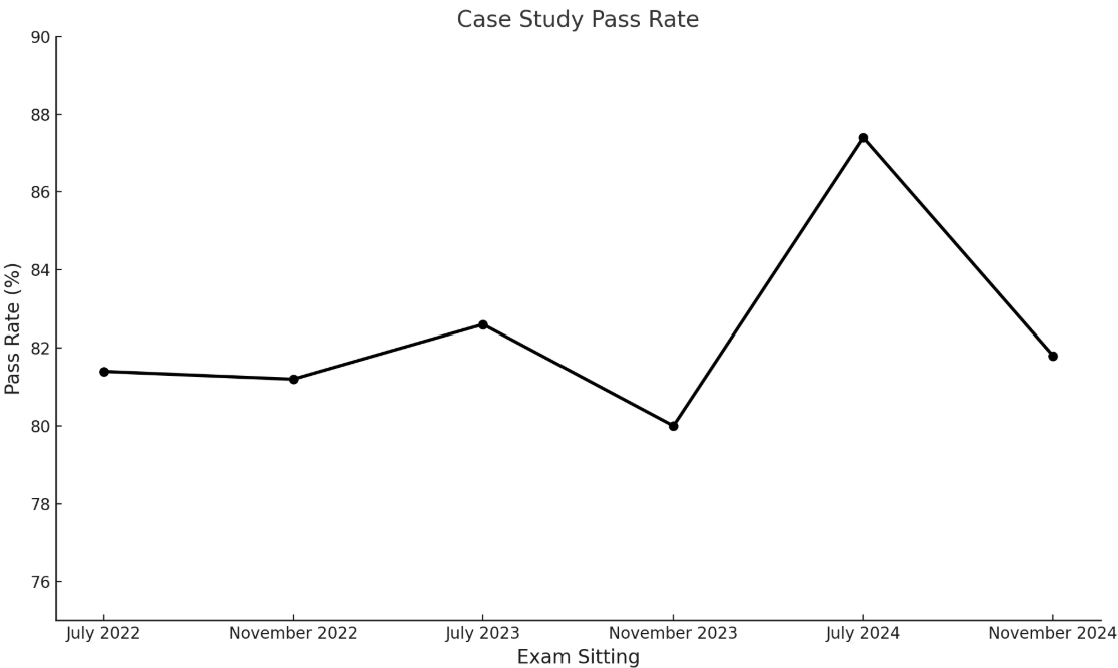

Global Case Study Pass Rate Takes a Tumble

A notable 6 percentage point drop can be explained by a very challenging paper.

A Perfect Storm of Challenges

For the second November in a row, a challenging exam paper seems to have caused problems for many students, leading to a significant dip in the pass rate.

Breaking Down the Requirements

Requirement 1: A Cash Flow Curveball

Requirement 1 introduced a novel element that caught many candidates off guard. For the first time in the exam's history, students were asked to provide detailed comments on the Statement of Cash Flows. This departure from the norm would have upset many plans to capitalise on Requirement 1 being the easiest of the Requirements.

Requirement 2: Pricing Policy Problems

The second Requirement proved to be equally challenging, tasking candidates with analysing three distinct pricing policies. Having as many as three different options to analyse is very unusual in Requirement 2 and would have taken up a lot of precious time in the exam.

Requirement 3: The EBITDA Enigma

If the first two Requirements weren't taxing enough, the third delivered what many described as a 'sting in the tail'. Contrary to the expectations of many, candidates were presented with a Requirement that combined an EBITDA model analysis of a proposal to implement AI with an apparently unconnected second request to perform a company valuation.

The integration of these typically distinct topics into a single Requirement caught many by surprise.

Implications and Moving Forward

The drop in the pass rate serves as a wake-up call for both students and training providers.

For future candidates, the November 2024 sitting underscores the importance of:

- Developing a comprehensive understanding of all parts of the financial statements, including cash flows

- Honing the ability to analyse and compare multiple business strategies simultaneously

- Building the capacity to integrate various financial concepts and models in problem-solving

- Learning to "expect the unexpected" rather than assuming that the real exam will necessarily be the same as any preparatory Mock papers

While the reduced pass rate may be disheartening for some, it ultimately reinforces the high standards set by ICAEW and the value of the qualification in the professional world.

No Impact on Our Students

Despite the overall decline in pass rates, we are proud to report that our students' performance remained unaffected by these new challenges and was, as usual, around 10 to 12 percentage points above the ICAEW global average. This resilience can be attributed to the robust technique and deep understanding acquired through our comprehensive Case Study tuition course, which included five Mocks with detailed reviews as part of our taught course.

Your Path to Case Study Success

For those facing future Case Study exams, the November 2024 sitting serves as a stark reminder of the need for comprehensive preparation, critical thinking, and the ability to apply knowledge flexibly across various business contexts. With the right approach and effort, future candidates can rise to meet these challenges, but only if their tuition process pushed them well above passing standard so that they can cope with any curveballs on the day.

If you want to learn how to pass the Case Study exam with confidence, sign up for our Advanced Level subscription package. This comprehensive programme includes our Introduction to Case Study course, which has helped countless students navigate the complexities of this challenging exam.

Don't let the increased difficulty of Case Study catch you off guard – equip yourself with the skills and knowledge you need to succeed.

Comments ()